It’s no secret that crude oil prices have been falling over the last five or so months.

Refiners and consumers have more recently been impacted by the change, while the effects have been more noticeable and immediate to producers. Investment banks like Goldman Sachs and Standard Chartered are producing varied projections in crude oil prices, but both predict at least more short-term decline. And Saudi Arabia and other OPEC nations are adding more pressure to U.S. and Canadian producers by continuing crude output and cutting prices.

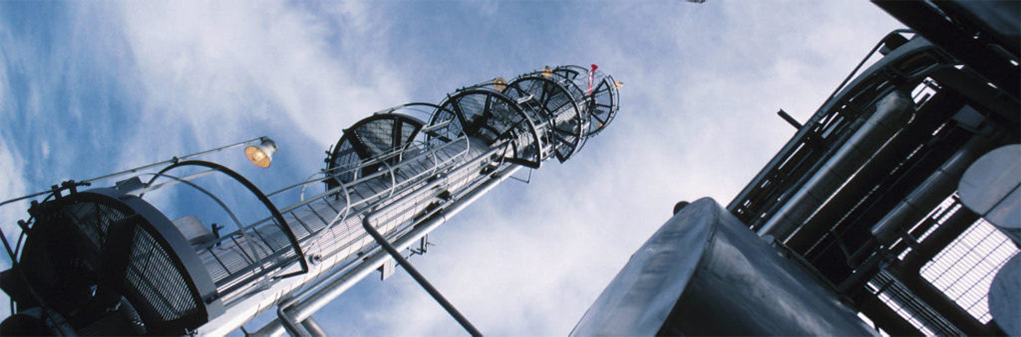

What does this mean in particular for entities running downstream processes? Integrated oil companies — those that include both production and refining operations in their portfolio — in particular may be able to fend off lower production profits with higher refining margins, at least in the short term. Essentially, when crude oil is cheaper, refined products like gasoline are cheaper to produce, leading to better refining margins and slower price reductions of refined products at the consumer level. This is evident in the third-quarter downstream profits of companies like BP, Shell, Exxon Mobile, and Chevron. This offsetting in production losses may last only so long in a sustained environment of reduced crude oil prices, however. Even pure refinery operations, which have done well in the third quarter, may still have to face thinning price margins and a sluggish economy.

The situation gets trickier for non-integrated upstream companies that can’t fall back on refining margins. It’s even worse for producers lacking pipeline infrastructure — like those trying to get Canadian oil sands production to the U.S. Gulf Coast via the stalled Keystone XL pipeline or to the Canadian East Coast via the Energy East Pipeline — to more effectively get crude to refineries. Despite the importance of rail traffic and its flexibility to producers, pipelines still make up 90 percent of the movement of crude and refined petroleum products in the U.S. The failure of several Bakken pipeline proposals over the last couple of years hasn’t helped the situation either. If the Saudis and OPEC continue to apply pricing pressure, already expensive U.S. shale production lacking pipeline throughput may become less attractive in the short term.