Want to share this article?

How the Inflation Reduction Act Is Rewarding Carbon Capture and Hydrogen Initiatives

How the Inflation Reduction Act bill rewards carbon capture initiatives with tax credits

Signed into law in August 2022, the Inflation Reduction Act bill (IRA) (ref. 1) includes approximately $360 billion to incentivize clean energy projects. The EPA believes these incentives will help reduce US emissions by approximately 40% by 2030 (ref. 2). With government incentives reaching historically significant levels, the question has changed from, “Is now the right time to implement a clean energy project?” to “What clean energy transition project should we start today?”

The Inflation Reduction Act bill—Are carbon capture, utilization, and storage projects cost-effective?

Experts anticipate that carbon capture, utilization, and storage (CCUS) projects will multiply over the course of the next few years. Why? The most important factor—the IRA increased incentives for permanent sequestration of CO2. Formerly capped at $50 per metric ton, the potential for government funding expanded to $85 per metric ton. Notably, annual capture requirements were lowered substantially from 100,000 metric tons of CO2 per year to 12,500 metric tons.

Section 45Q (ref. 3) of the IRA supplies details on different kinds of projects and industries. For example, direct air capture (DAC) requirements reduced from 100,000 to 1,000 metric tons, and incentives increased from a maximum of $50 to $180 per metric ton.

A substantial increase in incentives, partnered with lowering the carbon capture requirements, is swaying companies in the energy sector to begin projects sooner rather than later. Furthermore, timelines often present challenges when it comes to completing facility modifications. By changing the commencement-construction deadline on 45Q-eligible projects from 2026 to 2033, the IRA made complex carbon capture upgrades achievable.

Clean energy benefits for jobs and communities

Secondary, but not less important, IRA initiatives include:

- Incentivizing energy companies to invest in implementing clean energy projects that also create jobs in formerly marginalized communities

- Producing apprenticeships in the energy sector

- Adhering to prevailing wage requirements

The Inflation Reduction Act bill—Accelerating the adoption of clean hydrogen

The clean hydrogen economy also benefits from the IRA. Roughly 95% of all consumed hydrogen is “gray.” Produced from the steam methane or auto-thermal reforming of natural gas with no carbon reduction, gray hydrogen can be impacted by clean energy initiatives much as any other type of emission.

The IRA introduces several new incentives for producing clean hydrogen. Clean hydrogen results from processes where the life-cycle greenhouse gas emissions rate stays below 4 kilograms of carbon dioxide equivalent (CO2e) per kilogram of hydrogen. Construction on these projects must begin no later than January 1, 2033.

Credits are available on a graduated scale—with the base amount set at $0.60 per kilogram of clean hydrogen. The maximum rate (adjusted for inflation) will be capped at $3 per kilogram with other variables required.

Currently, industrial fertilizer and chemical plant applications consume most of the hydrogen produced. However, more sectors—from transportation to power generation—will begin to evaluate the viability of using hydrogen as a replacement for traditional fossil fuels based on IRA incentives and global energy transition initiatives. Section 45V of the IRA gives specific details.

Inflation Reduction Act bill—Supporting the development of clean hydrogen infrastructure

The International Renewable Energy Agency (IRENA) (ref. 4) estimates that hydrogen and its derivatives could represent as much as 12% of total worldwide energy consumption by 2050. Additionally, IRENA visualizes biomass as comprising 18% of energy consumption by that same year.

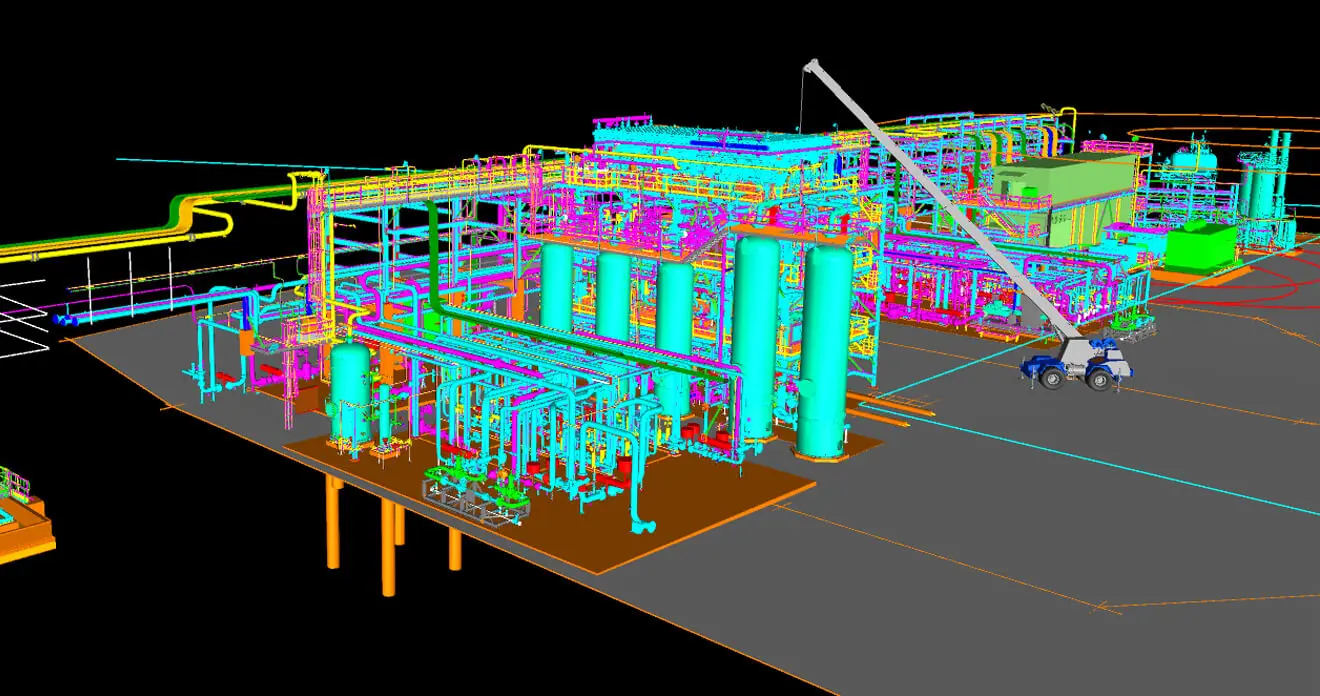

The IRA broadens the range of facility types that qualify for tax credits, including refining, power generation, steel, and cement plants. This expansion drives investment in new infrastructure, as well as brownfield modifications and upgrades.

With incentive programs for ramping up “blue” and “green” hydrogen infrastructure, IRENA’s estimates for energy transition become achievable—and clean energy projects now make sense from an ROI perspective.

Looking ahead to a cleaner future

The need for energy is not diminishing. A cleaner energy future requires innovation, commitment, and follow-through from government entities, businesses, and consumers. While traditional fossil fuels will likely remain the workhorse of the energy sector, deploying new technologies for energy infrastructure helps the world transition to sustainable energy over time.

As a leader in alternative fuels, Audubon provides a portfolio of engineering, procurement, construction, fabrication, and technical capabilities that span the entire clean energy value chain. Our team is committed to helping clients utilize provisions in the Inflation Reduction Act to improve project economics and achieve decarbonization at scale. As a full-service EPC provider, we develop and execute energy transition strategies that meet sustainability goals while maximizing operational performance and long-term profitability.

About the author

David Beck is Managing Director at Audubon Engineering Company. With more than 25 years of experience in executive management and business development in the oil and gas industry, David’s expertise extends to international and domestic operations, midstream gas processing, midstream services, and LNG/GL recovery. David holds dual Bachelor of Science degrees in Chemical Engineering and Biochemistry from Texas Tech University.

References:

About the author