Want to share this article?

The Encouraging Economic Future of Deepwater E+P Activities

Despite facing political and regulatory challenges, the outlook for deepwater exploration and production looks promising as production from onshore and shallow-water basins slows.

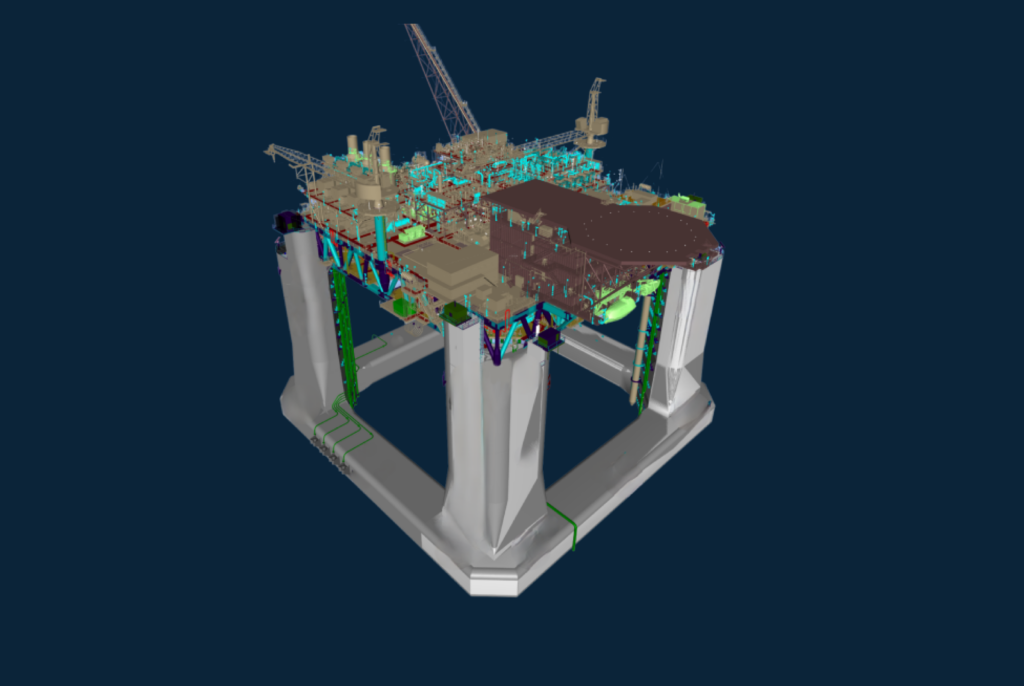

Between 2014 and 2018, global deepwater expenditure is forecasted to increase by nearly 130%, totaling $260 billion. Brazil, the U.S. Gulf of Mexico (GoM), Angola, and Nigeria constitute for 82% of the capital expenditure, respectively, with West Africa anticipated to have the greatest regional growth.

The GoM remains a geopolitically stable player as the hub for US-based, deepwater activities despite the 2010 Macondo blowout and the temporary ban on drilling more than 500 meters, which significantly impacted GoM developments. Since the moratorium was lifted in 2012, normal drilling activities have resumed, and the economic signs of recovery are evident. Development plans currently underway may further potential production to nearly 80% by 2020. Major operators Shell, Chevron and Anadarko are forecasted to have the largest estimated expenditure, totaling $19 billion between 2014 and 2020. Anadarko alone has a capex of $10 billion from 2014 to 2020 for its Lucius, Heidelberg, and Shenandoah projects. By 2015, the GoM production level is forecasted to reach 7.9 million barrels per day, up from the current 4.9 million according to U.S. Energy Information Administration.

With the economic viability of deepwater developments, the market is seeing new opportunities emerge in other parts of the world, such as Australia and Indonesia, as well as a strong interest in creating and using new technologies, such as 3D seismic surveying, to tap into potential discoveries of large hydrocarbon reserves.