Want to share this article?

Condensate Splitters in Demand for Eagle Ford

The demand for condensate splitters in the Gulf of Mexico increases as the production of hydrocarbon mixture surges in the South Texas Eagle Ford Shale.

Condensate, a very light form of crude oil, represents nearly half of the Eagle Ford’s oil output. Because demand for condensate is minimal in the Gulf of Mexico, companies are seeking opportunities to export the product to areas where demand is robust.

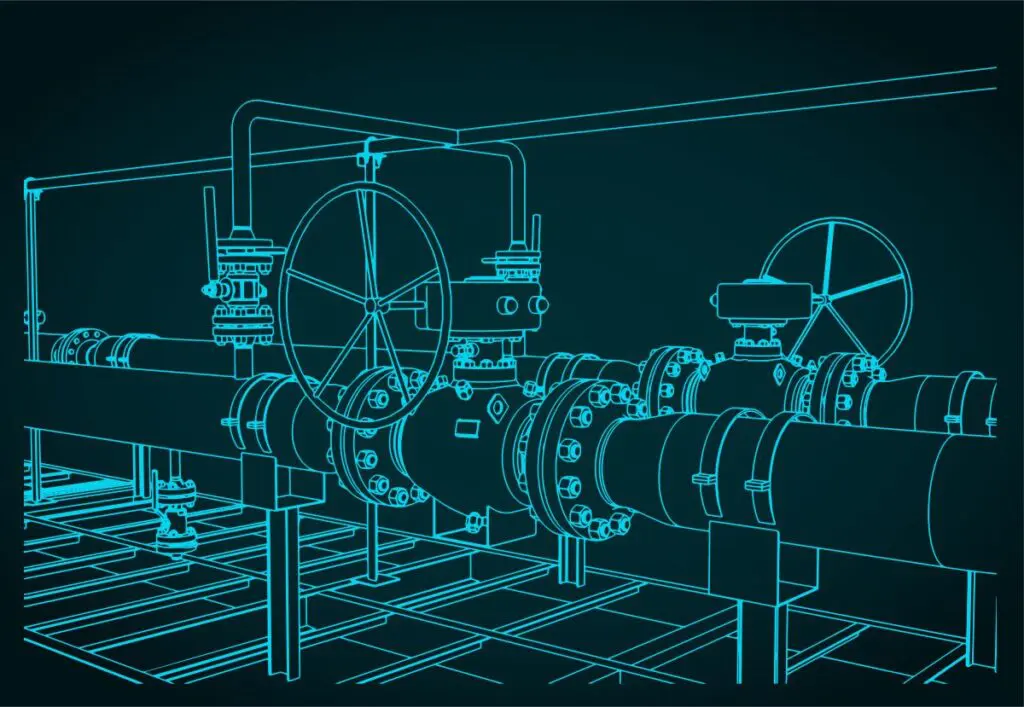

Splitters – a basic distillation tower – give condensate a minimal level of processing by refining oil into byproducts, such as naphtha, that can be exported to refiners and blenders. Without such processing, condensate is considered crude oil under U.S. law and cannot be exported.

Forecasters predict that the Eagle Ford’s total condensate output will reach 250,000 to 400,000 bpd by 2020 compared to the 130,000 bpd average produced in 2011.

To keep up with the expected demand, analysts suggest that the U.S. Gulf Coast may need more than half a dozen splitter facilities to turn condensate into exportable products and leverage the growing surplus of condensate output from the Eagle Ford shale. At least four new stand-alone condensate splitters are being planned in Corpus Christi and Houston.

The low cost of condensate compared to crude oil makes it an option worth considering for many companies. In the absence of U.S. demand, condensate can be discounted by as much as $15-20/bbl versus traditional light sweet crudes.

For companies looking to enter the condensate export market, splitters represent an investment of about $200 million compared to the billions it costs to build a new refinery.