Want to share this article?

The Importance of Due Diligence in Midstream Transactions

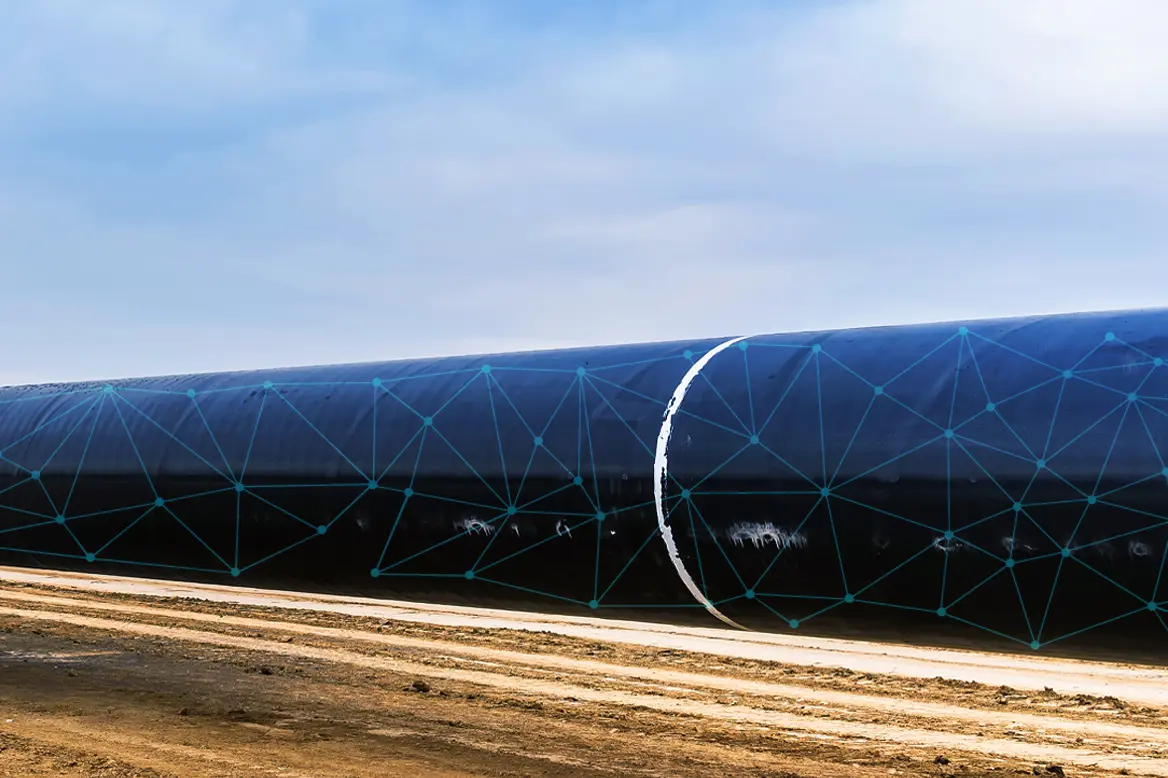

In the coming years, activity in shale plays across the U.S. will lead to the construction, transfer, and sale of billions of dollars in midstream assets.

Often covering thousands of square miles and governed by multiple regulatory frameworks, pipelines and facilities can present a wide range of challenges in terms of compliance and liability that must be met with thorough due diligence in order to protect the interests of operators and investors.

The goal of any due diligence process is not only to quantify the risks associated with ownership of a targeted asset, but also to identify any obstacles that will affect its acquisition or prevent investment objectives from being achieved. When it comes to oil and gas pipelines/facilities, this can often boil down to EPA, DOT, or OSHA compliance.

In addition to the difficulties that come from having to precisely coordinate with state, federal, and local authorities, unforeseen environmental risks and/or sub-optimal route selection frequently results in a monetary loss for the owner/operator. It can also have a lasting impact on landowners, townships, and surrounding ecology as well. Facilities construction materials, design standards, and documentation are additionally critical to the on-going operation.

In order to maximize protection against such risks, pipeline due diligence should include a thorough investigation of system maps, petroleum or water supply lines, shared facilities, terminal sites, schedules of easements, and right of ways. Determining what type of property title diligence currently exists and if it can be built upon is also important to minimizing liability. So is having an understanding of pipeline decommissioning and/or asset retirement obligations.

Even with comprehensive acquisition agreements, there are certain issues that even the most extensive contractual protections simply will not cover. Effective due diligence helps lower the risk and the related costs of a “failed” deal by reducing the number of events or occurrences that can derail a multi-million dollar midstream transaction.